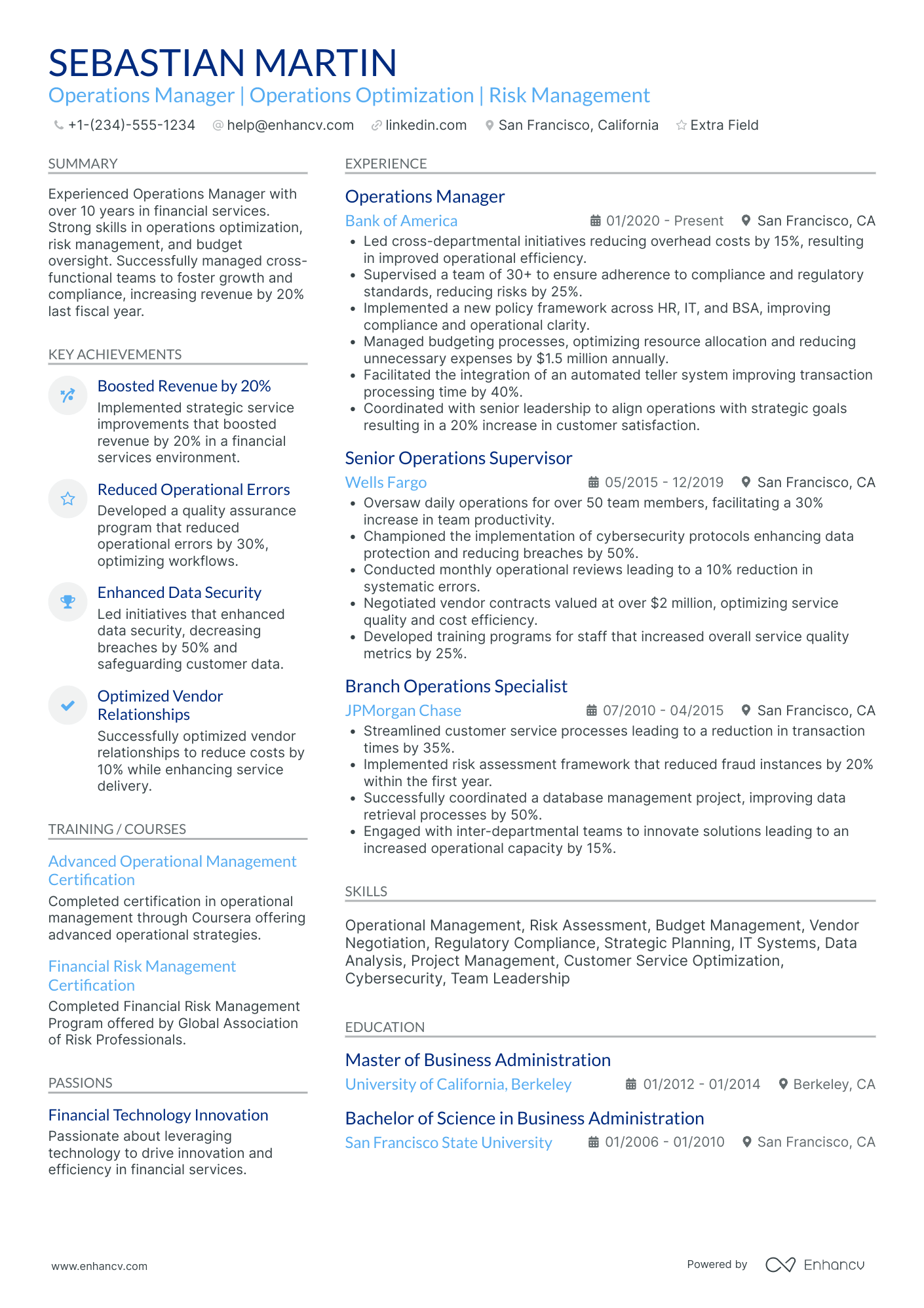

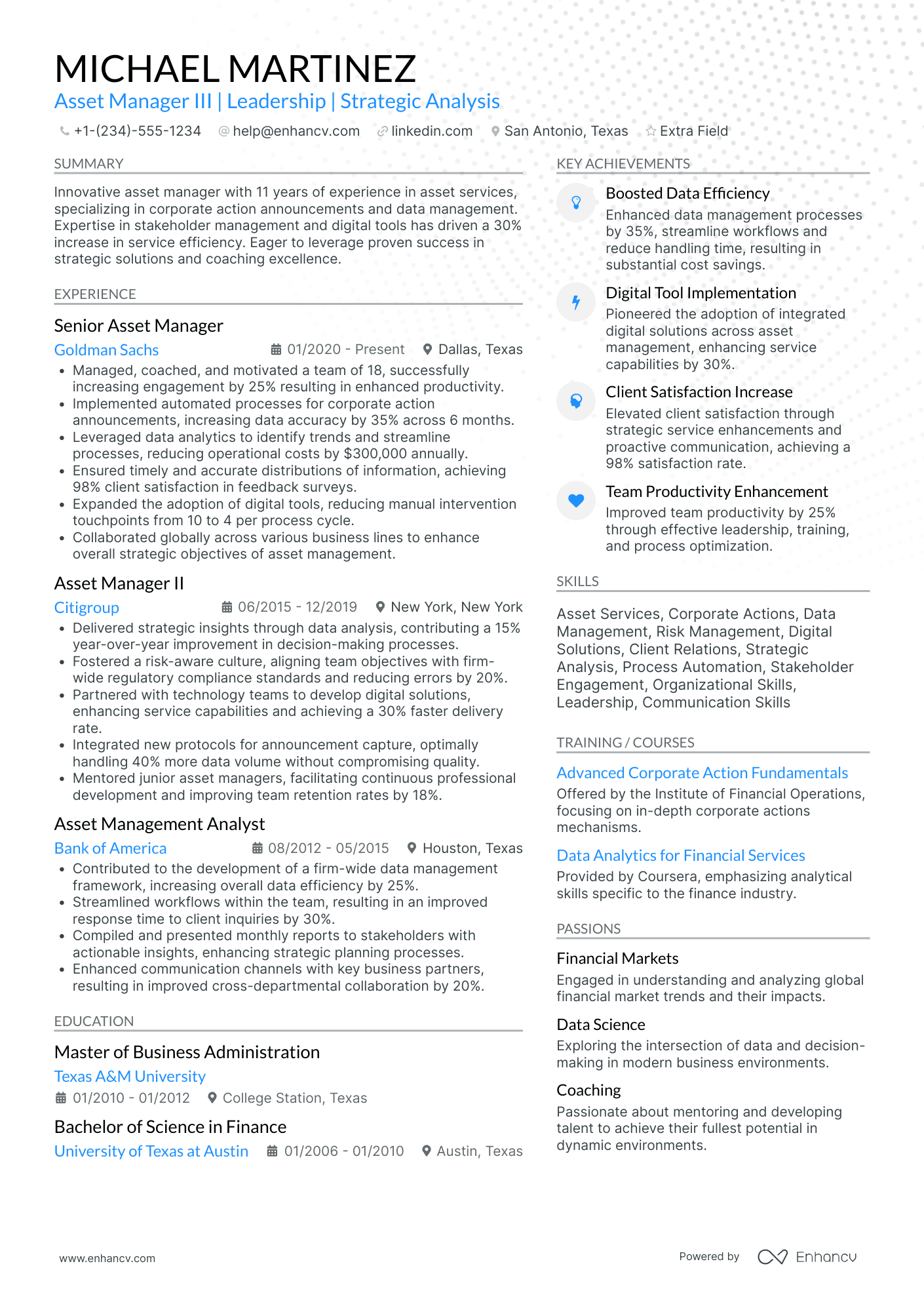

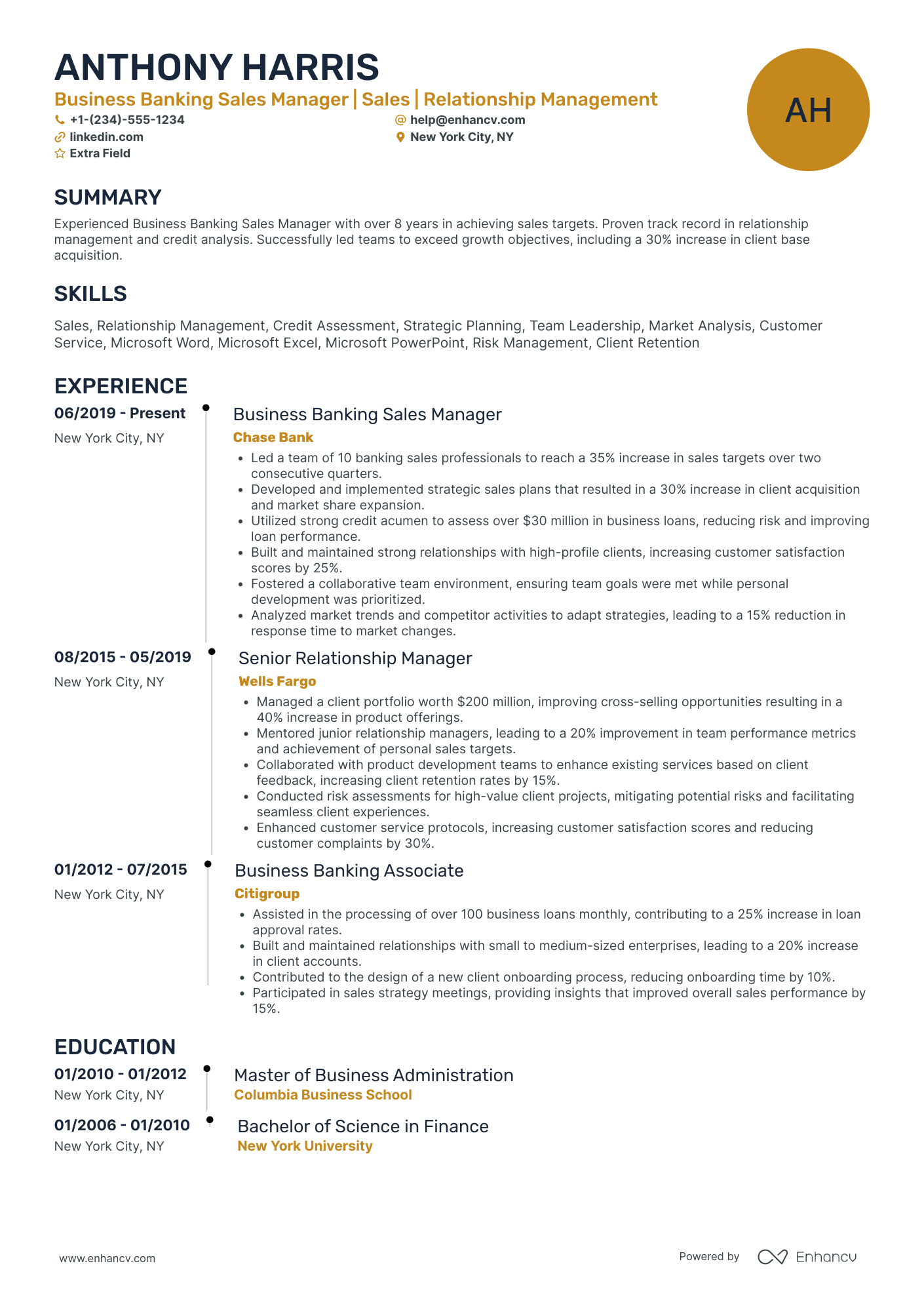

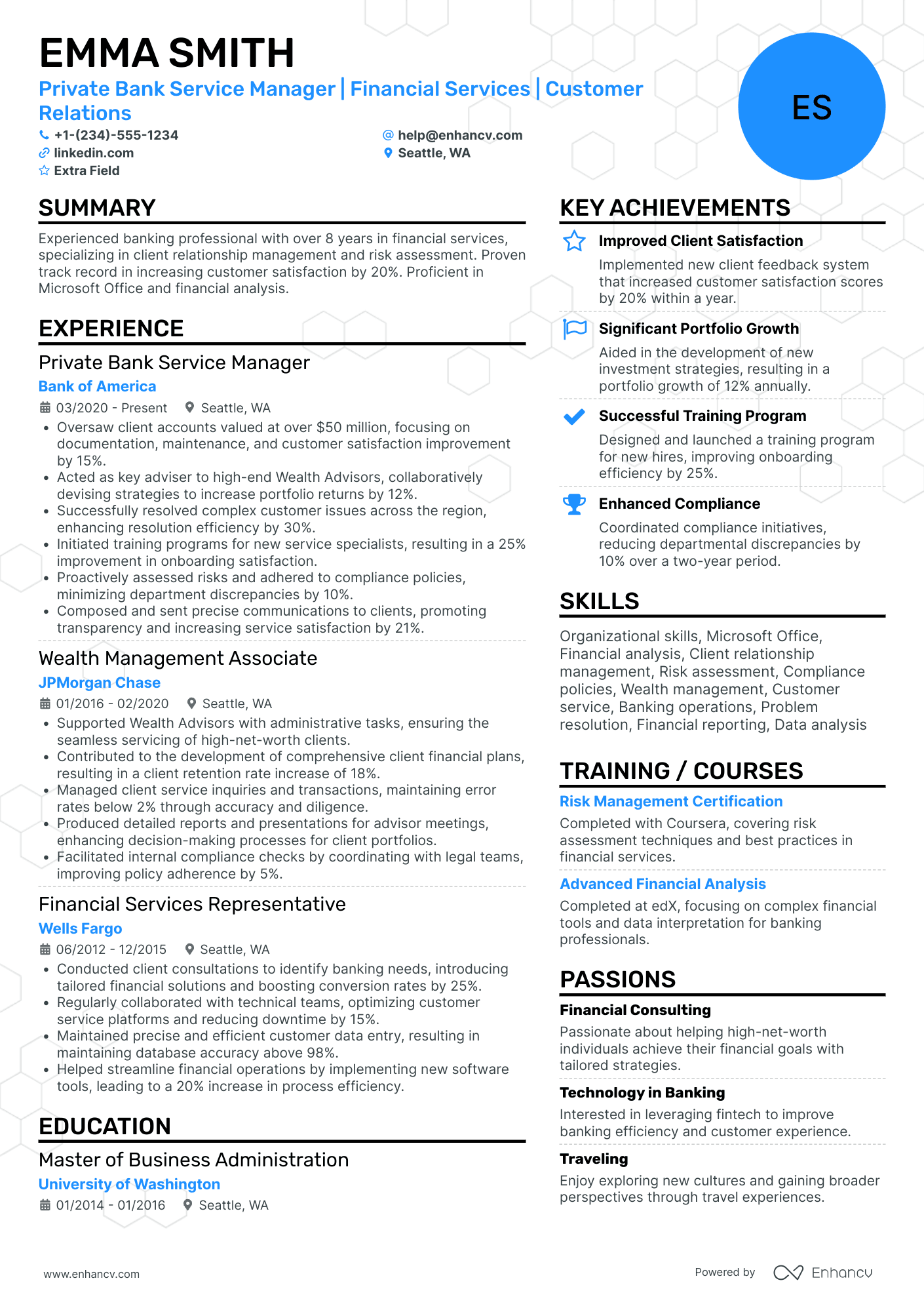

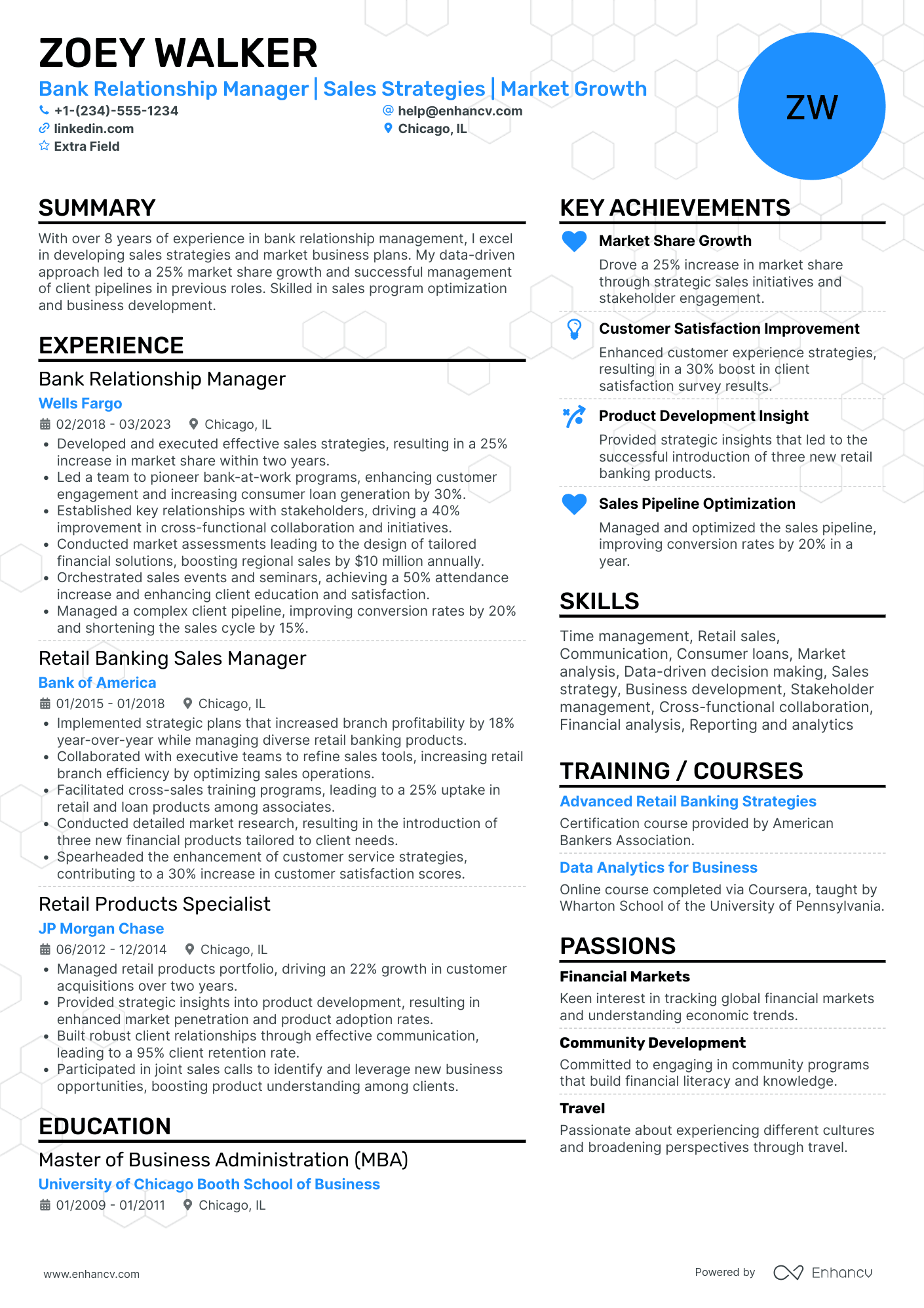

Bank Managers often find it difficult to concisely represent their extensive experience and diverse skill set on a one-page resume. Our resume examples provide clear and tailored templates that highlight critical leadership and financial management skills effectively. Explore these examples to enhance your resume's impact.

Bank Manager resume examples

By Experience

Assistant Bank Manager

Senior Bank Manager

Associate Bank Manager

By Role

Bank Branch Manager

Bank Branch Manager positions have strong roots in financial planning and customer service, which is why trends in these domains influence bank management trends globally.

When applying for Bank Branch Manager jobs in the banking industry, keep these points at the forefront:

- Competency in branch operations management is crucial. Delivery channel management, security & compliance, audit & budgeting are some practices you could have dealt with.

- Ensure to include relevant experience in these operations and your skills in the management area, or your application might get overlooked.

- Highlight financial planning expertise affecting the branch's success. Many successful Bank Branch Managers have well-rounded financial backgrounds. Feature your economic skills and how they have impacted the branch's financial health on your resume.

- Don’t simply list your finance skills. Illustrate how they contributed to the growth of the branch and its operations, e.g., 'improved bank's profitability by....', 'increased customer deposits after....' and so on. Stick to the 'skill-action-results' formula.